The primary rationale of rounding in accounting is to provide a more accurate assessment of a company’s financial state. However, if the rounding is done incorrectly it can result in an inaccurate assessment and presentation of a company’s financial state.

There are different definitions for rounding: in accounting it means reducing the number of decimals in a number by “rounding” the number to a specified decimal value. This action could result in either an increase or a decrease in value.

When implementing an accounting system the method of rounding is not an informal and obvious decision, it needs to be more purposeful. There are two primary considerations an organisation will need to make when it comes to rounding.

- What rounding methodology will be followed; this is usually dictated by the legislation of the country or region in which the organization operates.

- At what point in the sequence where one is working with a complex or multiple stage transaction method, will the rounding be performed.

With the event of the ’Global Village’ rounding becomes more of a challenge when working with various currencies as part of a single transaction, and where settlement discount as a percentage is allowed. The currency conversion process is an intricate one, with the question as to what rate to use – the rate on the day the transaction was raised, the rate the on the day the payment is made or the average of the two – or perhaps you would be sufficiently forward thinking to peg your rate.

Some example rounding methods are:

1. Conventional Rounding

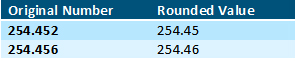

In general, the last digit in a value will be rounded. For example if you want to round to two decimals, one should round off the third decimal.

If the decimal that one requires to round is over 5, you will round the preceding decimal upwards 1. However, if the decimal is less than 5, you will not adjust the preceding decimal, but instead just delete the subsequent digits up to decimal you want to round to.

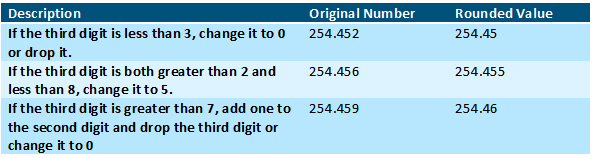

2. Argentina Rounding

This method prescribes the following approach:

This rounding does not always cause the precision (number of decimal places after the decimal point) to be reduced.

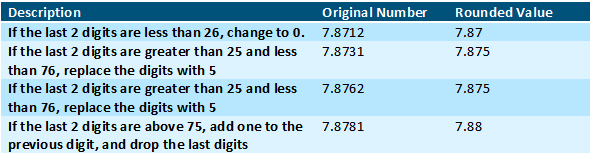

3. Swiss Rounding

This is similar to the conventional rounding method, but the offset is by 0.25:

When should rounding take place?

The general rule of thumb is to perform the rounding at a transactional level, and as late in the process as possible in order to minimize the potential cumulative impact the rounding might have. When calculations are being performed, rounding should only be applied to the final answer.

However when working in an accounting environment, this might not be possible as the ‘complete’ transaction might not be concluded in one single effort on a single day. Depending on the organization and the nature of the business, the company might choose to perform rounding at a transactional level in real-time, or the company could decide to perform the rounding on a day level (summary level batched).

When working in a high transaction environment, SYSPRO has the functionality you need to make a carefully considered choice about rounding, as it does support different rounding methods. It would interesting to hear your ideas about rounding ‘best practices’.

1 thought on “Rounding for accounting accuracy”

what if the 49.989? it is consider 50?